If the feedback on early drafts is any indication of future comments, I suspect that this post will generate some good discussion. As I stated previously, my hope is to crystallize my own thought process so constructive feedback is welcome. And apologies in advance as this post is a bit longer than I originally anticipated and not as crisp as it should or could be. Here it goes.

Intro

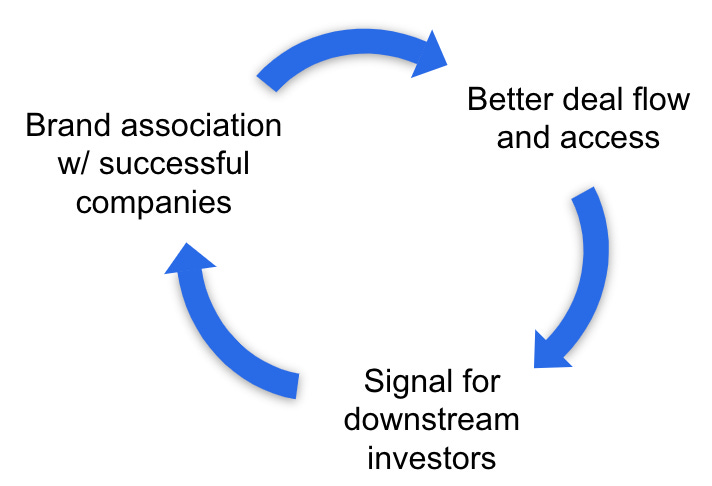

Brand is arguably the only thing that resembles a moat in traditional venture capital. The venture capital flywheel archetype is pretty simple: pick and invest in great companies and founders, support those founders and companies, and over time those founders and companies, particularly if they are successful, lead to more deal flow and better access, etc. An overly simplified version might look something like this:

Brand

First, let’s define what I mean by Brand. For me, Brand is reputation and access. Specifically, the ability to access a deal at a given check-size and target ownership. Brand is an amorphous concept in venture. We often associate brands with the number of Twitter followers, Substack subscribers, or even returns. While those things can be a pieces of brand, it’s not the only thing or even the most important thing in building a brand. Nikhil Basu Trivedi put this better than I could as I we were debating this idea, “Brand is built across lots of different media (e.g., content, in meetings, through word-of-mouth, at events), but also built with a bunch of different constituents - founders, obviously, but also other board members, co-investors upstream and downstream, LPs, executive teams, college talent, seasoned talent, the broader world.”

So why does this matter? Well, in my mind, venture capital is increasingly competitive so a key question then is, “Will this entrepreneur choose to work with me and our Firm over a competing term sheet on the same or better terms?” In short, access matters, and given the increasingly competitive environment and transparency, it matters more than most VCs believe. And while access is not sufficient to produce great returns it is a key component. Here is a recent thread from Fred Destin that neatly captures the point I’m trying to make:

Although I disagree with the wording, the last piece is critical:

Venture investing used to be about “picking”; now it’s about “getting picked”

I would say that venture investing is increasingly about “getting picked”. Shawn Merani at Parade Ventures drove this home in his feedback on this post:

Having conviction and having a point of view produces returns

I agree. Let me make this crystal clear now -- “picking” matters. This post is focused on the concept of access. Even for insight-driven investors, access and brand matters. You still have to convince a founder to let you tag along for the next several years as they build their company. It matters even more if you are joining the board. Plus, if your brand is powerful enough to warrant a discount on a market valuation then its even better.

Before going on to the next section, I think it's important to recognize there are the concepts of personal brand and firm brand. I’m focused on firm brands for the rest of this post. For emerging managers, I recognize that personal brand and firm brand are often the same thing. However, as firms scale, LPs need to shift their focus to the collective firm brand. Why? Well, simply, LPs can’t invest in a single Partner’s track record.

Brand vs. AUM

So how should you think about brand and building a firm? Here it all ties back to portfolio construction, fund size, and ownership.

Any firm can demonstrate increased ownership if their goal is to move upmarket. The question is whether the firm can increase ownership in quality founders and companies while avoiding potential adverse selection.

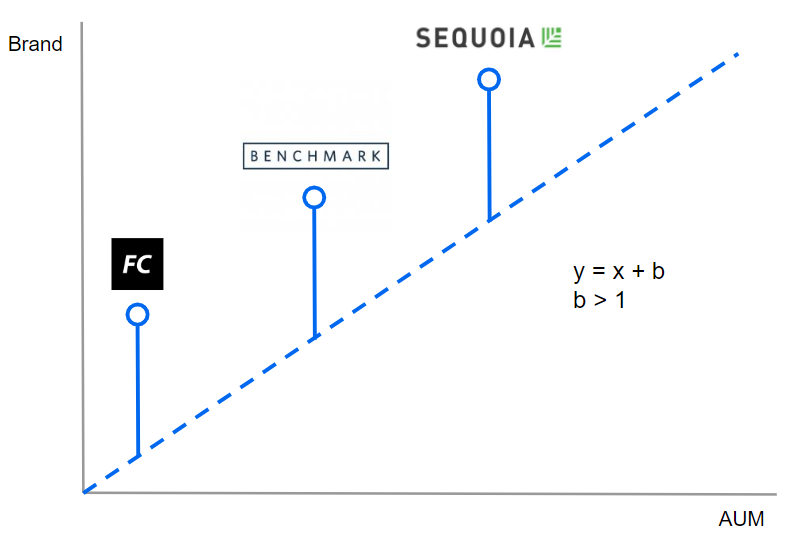

The concept for the chart below has been stuck in my head since a conversation I had with Chad Byers at Susa Ventures regarding fundraising. Chad and Susa were hyper-focused on earning the right to increase their ownership before scaling up their fund size. Chad had so clearly articulated Susa’s intention about building a brand in advance of future fundraises that it is now a lens through which I view most firms.

The ‘Blue Line’ is something I’m calling the Mendoza Line for Venture Capital Firms for lack of a better term. [Editor’s note: I love this concept. I first came across it in Rory Driscoll’s post here. Per Rory, “the Mendoza Line is a baseball term for the batting average below which a hitter is not worth hiring for Major League Baseball.”] In my example, above the line is [Magical Returns] where a firm’s brand exceeds its fund size. Below the line is [Mediocrity] where fund sizes and AUM outstrip a firm’s brand and lead to poor relative or absolute returns. [Editor’s note: These names/terms aren’t great but it is the best I could come up with🤷♂️. I’m open to suggestions.]

It is important to note that this does not imply that you can’t scale your AUM in venture capital. I believe Founder Collective, Benchmark, and Sequoia all have brands and funds in the [Magical Returns] section with very different fund sizes and strategies.

The best firms I’ve ever seen have persistent returns as they have a brand that outstrips their AUM by a very wide margin. If y = x + b then the best firms have a really high b. Again, while a really high b is not sufficient to create persistent returns, it is a foundational element, especially in the current market, or else some of the best founders will choose to work with other firms.

However, this is not to say that emerging managers can’t establish themselves in the [Magical Returns] chart and there are plenty of groups that were once new or emerging managers that have proven this point. Let’s use First Round Capital as a case study. Again, you can argue about where the firm actually sits on the chart, but what, in my mind at least, is inarguable is that First Round’s brand has increased at a rate that is substantially greater than the rate at which they have increased their fund size. In fact, in the last several fundraises their fund sizes barely increased at all while the FRC brand is increasingly associated with category-defining companies such as Uber, Roblox, Notion, Verkada and Looker.

The same is likely true for groups like IA Ventures, USV, Founder Collective, Homebrew, Pivot North, and others who have constrained their fund sizes. Other firms like Felicis and Forerunner have scaled AUM but have also bent the brand curve upwards over time.

One of the questions I often get from new and emerging managers is what mistakes do I see managers make early in their careers. For me, one of the biggest mistakes is what I would call Premature Scaling.

Premature Scaling happens when firms increase their AUM faster than they establish their Brand in the market and the curve bends in the opposite direction of the [Mendoza Line]. Part of the reason this is such a common mistake is because it’s really hard to realize this is happening in the moment and it takes a couple of fund cycles to assess whether the brand flywheel is spinning or not. What most emerging managers fail to see is that they become so beholden to their fund model and the requisite ownership that they unknowingly suffer from adverse selection -- back to the Mike Maples quote “Your fund size is your strategy.” This transition is particularly hard for those groups or individuals moving from angel to seed or single-digit initial ownership to large double-digit ownership as you often find yourself competing with groups you once considered friendly co-investors and collaborators. Again, this isn’t to say it can’t be done or to discourage emerging managers from moving upmarket. There are plenty of emerging managers who have successfully made this transition and scaled AUM including Forerunner and Felicis.

[Mediocrity] is a very dangerous place to be because it is much harder to build a Brand than it is to raise increasingly more capital in this market. The even scarier part is that this mistake can compound if the starting point for Fund I is significantly below the [Mendoza Line]. This is just one reason why LPs think a lot about fund size and portfolio construction.

Brand is a fuzzy thing. It’s really hard to quantify and isn’t really obvious until it is -- it is often perceived to be a lagging indicator of performance. However, I would disagree with that sentiment. It is a lagging indicator in the LP community for sure. But if you speak with founders and co-investors you’ll realize there are emerging managers who have very meaningful founder mindshare, reputation, and brand. That’s ultimately what I’m looking for.

Again, to tie this all back to the LPs perspective, the most important thing for me is understanding how the brand line is trending. My advice is to spend time building your brand by focusing on process; have conviction and a point of view, invest in your business, and do right by founders while also being a solid steward of LP capital. There are plenty of examples of firms who did the hard work on building their brands and reputations -- both in private and public -- and now the returns are starting to prove out. If your north star is to build a world-class venture firm with persistent, top-decile returns then be intentional about investing in your brand and balancing that with your AUM, fund size, and portfolio construction.

Thanks to Samir Kaji at First Republic, Chad Byers at Susa Ventures, Shawn Merani at Parade Ventures, and Nikhil Basu Trivedi for reading drafts of this post and providing feedback. This was a great exercise of learning in public so appreciate this group pushing me to think harder about the various ideas in this post.

thanks for mentioning us (Homebrew) here. You're absolutely right that we don't increase fundsize based upon LP or founder demand. We raise to a strategy and that strategy has remained consisted across all three funds. Same velocity, same ownership targets. The fund sizes have increased modestly only because (a) we've lengthened our investment periods (more companies per fund over more years) and (b) seed valuation inflation :)

Hello Craig,

I hope this communique finds you in a moment of stillness. Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to open it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.